NOL CARBON TAX

NOL CARBON TAX

NOTICE OF LIABILITY

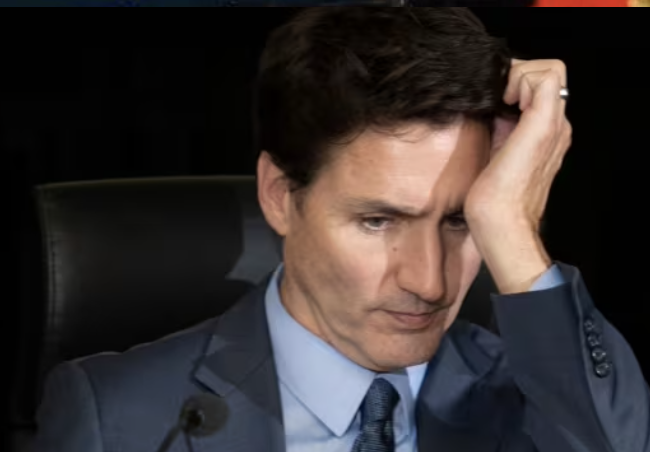

JUSTIN TRUDEAU AND

THE GOVERNMENT OF CANADA

FOR IMPOSING HARMFUL CARBON TAX

Jane Doe, private human, of lawful and legal age of majority; presents this notice of liability to Justin Trudeau, private human, of lawful and legal age of majority; And to the Government of Canada.

Stephan Harper has violated his fiduciary duty to Canadians by signing unconstitutional, undemocratic, and unreasonable agreements with China (Foreign Investment Promotion and Protection Act [F.I.P.P.A]) in 2010, Justin Trudeau in 2019 has done the same by signing the United Nations Agreement (North American Agreement on Environmental Cooperation [NAAEC]) regarding foreign interference with our natural resources. Surrendering control of our natural resources intended to benefit Canadians, by conspiring with foreign powers, is an act of treason under section 46 of the Criminal Code of Canada because it undermines our Canadian Sovereignty.

The “Rule of Law” in Canada is set in our Constitution which is based in Common Law and ensures our Government must protect our liberties and democracy. In this case Trudeau has committed treason by conspiring with foreign powers to undermine the sovereignty of Canada. (“Rule of Law” case law Campbell Motors Limited v. Gordon, 1946 CanLII 242 (BC CA))

The Supreme Court of Canada on October 13, 2023 ruled that the Federal Government has no authority to pass laws regarding natural resources, even if they have signed an international agreement. (https://www.scc-csc.ca/case-dossier/cb/2023/40195-eng.aspx).

This SCC case law, and section 92 (2) and 92 A (1-6) of the Constitution, gives the provinces exclusive jurisdiction over nature resources and direct taxation therefore, the Constitution precludes the Federal Government from taxing natural resources such as Trudeau is doing with the national carbon tax.

Unfortunately, the SCC has cleverly been convinced by the Federal Government that the carbon tax is not a tax but rather a price which they are allowed to levy. Regardless we, the people do not accept that a price or a tax be applied to natural resource consumption.

Seven provincial premiers have publicly announced they do not support this tax. Premier Scott Moe of Saskatchewan has proclaimed he will not collect and remit this carbon tax. These seven premiers represent more than 50% of Canadians. According to the people of Canada this tax is unacceptable.

Given that the Federal Income Tax Act has been deemed unconstitutional by the Supreme Court of Canada (Attorney General of Nova Scotia v. Attorney General of Canada, 1950 CanLII 26 [SCC], [1951] SCR 31) because it is not consistent with Section 92 (2) (exclusive provincial power for direct tax). And as well, Section 91 (15) designates that the Federal Government has exclusive power to issue paper money, making it unnecessary to apply direct tax such as the income tax or carbon tax in order to raise money.

Therefore, if you wish to retain my 2023 tax remittance taken illegally, you must immediately withdraw the carbon tax.

If this cancellation of tax does not occur by ____________I will issue a statement of claim against Justin Trudeau and the Government of Canada to acquire tax exempt status retroactively based on the 1950 case law and the related Constitutional sections indicated above.

If Canada is to survive as a free democratic society the executive of the Government of Canada must begin to obey the “Rule of Law” and the people need to hold violators accountable with civil and criminal complaints. By protecting our inalienable human rights and fundamental freedoms embraced in our “Rule of Law” the Government can facilitate a continued voluntary cooperation with Federal income tax going forward.

Sincerely,

Jane Doe

TO SERVE DOCUMENTS

LINK TO THIS DOCUMENT: https://docs.google.com/document/d/1wG_UmMbj7qsjAw_dJdJBna36FYO_6tco/edit?usp=sharing&ouid=109411343159942103930&rtpof=true&sd=true

EMAIL TO JUSTIN TRUDEAU AT https://www.pm.gc.ca/en/connect/contact. Just copy this document link to Justin’s email page and send. Be sure to add your deadline for his response,

EMAIL TO THE ATTORNEY GENERAL OF CANADA mcu@justice.gc.ca HERE: mcu@justice.gc.ca